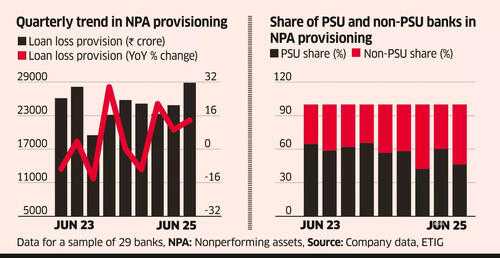

The quarterly loan loss provisioning by the banking sector reached a three-year high in the June quarter, largely due to heightened provisioning by the private sector banks while their public sector counterparts ( PSU banks) reported lower provisioning at the aggregate level. For a sample of 29 banks, NPA provisioning rose by 12% year-on-year and 16.2% from the previous quarter to ₹28,883.6 crore. The prior high was in the June 2022 quarter at ₹29,120 crore. Given the recovery and collection trends, slippages in the MSME segment are expected to slow down in the coming quarters, which may result in moderation in provisioning.

The sample's NPA provisioning has shown a year-on-year increase for the third consecutive quarter as a few banks reported one-off provisioning. In a sector report, Kotak Securities pointed out that HDFC Bank undertook prudential provisioning towards the stake sale in HDB Finance while Axis Bank showed higher provision due to change in provisioning policy. " Credit costs across lending segments did not show any worrying signs, except for a marginal blip due to a seasonally weak June quarter," the broking firm noted.

For the private sector banks in the sample, loan loss provisioning increased by 40.4% year-on-year to ₹15,527.2 crore. It was the highest since the June 2021 quarter when it had touched ₹17,083.3 crore. Kotak Mahindra Bank, Federal Bank, and South Indian Bank were some of the private sector banks that recorded over two-fold jump in NPA provisioning from the year-ago levels.

Loan loss provisioning for PSU banks fell by 9.3% YoY to ₹13,356.4 crore. Majority of the PSBs, seven out of twelve to be precise, reported a drop in NPA provisioning from the year-ago levels. The share of PSU banks in provisioning for bad loans fell to 46.2% in June quarter from 57.1% in the year-ago period.

The sample's NPA provisioning has shown a year-on-year increase for the third consecutive quarter as a few banks reported one-off provisioning. In a sector report, Kotak Securities pointed out that HDFC Bank undertook prudential provisioning towards the stake sale in HDB Finance while Axis Bank showed higher provision due to change in provisioning policy. " Credit costs across lending segments did not show any worrying signs, except for a marginal blip due to a seasonally weak June quarter," the broking firm noted.

For the private sector banks in the sample, loan loss provisioning increased by 40.4% year-on-year to ₹15,527.2 crore. It was the highest since the June 2021 quarter when it had touched ₹17,083.3 crore. Kotak Mahindra Bank, Federal Bank, and South Indian Bank were some of the private sector banks that recorded over two-fold jump in NPA provisioning from the year-ago levels.

Loan loss provisioning for PSU banks fell by 9.3% YoY to ₹13,356.4 crore. Majority of the PSBs, seven out of twelve to be precise, reported a drop in NPA provisioning from the year-ago levels. The share of PSU banks in provisioning for bad loans fell to 46.2% in June quarter from 57.1% in the year-ago period.

You may also like

SC: Victims of crime, their heirs can appeal if accused are let off

Message From Begums Of Bhopal: Lead A Clean, Drug-Free Life

Two married couples dead after 'Brit car ploughs into tree in Germany'

Madhya Pradesh: Over 1.53 Lakh Bird Guards Installed On EHT Lines In State

Arsenal agree record transfer deal in latest coup after Eberechi Eze hijack